Situation

Aventine operated in a volatile, narrow-margin business environment. In order to make data-informed decisions on the fly, employees needed to be armed with the most up-to-date information. Unfortunately, limited visibility to financial data severely diminished decision-making and strategic planning capabilities.

The finance department prepared static reports, but they had several drawbacks:

- They were only delivered once per month, which is not frequent enough.

- They were backward-looking, always a month behind.

- They were limited, excluding critical financial metrics.

- They were summarized, showing numbers in aggregate with no ability to drill down into data.

Not only are these reports inadequate, but they are also manual and time-consuming to produce. Moreover, because the reports do not meet the needs of employees, the finance department often has to spend additional time completing ad-hoc reports and analysis for specific requests.

Actions

I led effort to implement business intelligence software tools. Once tools were implemented, I developed a series of scorecards, dashboards, and reports to allow teams to monitor operational and financial performance. Specific activities are summarized detailed below.

01: I worked with business teams that needed access to data to understand requirements

Step 1: Conducted one-on-one stakeholder interviews with all parties:

- C-Level Officers

- Senior executive team members

- Management team members (multiple departments)

- Front-line employees (multiple departments)

Step 2: Organized all information, preparing various self-referencing documents that articulated business goals and requirements.

- Documents included

- Goals & Objectives – Enterprise & Departmental strategic objectives, Supporting KPIs and metrics

- Personas – Persona details, goals, List of tasks (What decisions does persona make with data?)

- Task Analysis – Data needed for each task. Steps involved in each tasks

- Dimensions & Measures – List of dimensions and measures required. Related personas./ Data permission level (to restrict visibility of sensitive data)

Step 3: Created wireframes which illustrated possible dashboard layouts

This was an iterative process which required continuous feedback from stakeholders

02: I worked with the finance department to understand data architecture of financial system and their process.

Step 1: Conducted stakeholder interviews with select members of finance team to discuss:

- Process used to create monthly reports

- Data points included on reports

- Financial assumptions

- Manual calculations

- Process used to conduct ad-hoc analysis

- Most common ad-hoc requests

- Pain points and challenges to compiling report and conducting ad-hoc analysis

Step 2: Updated previously created requirement documents with new information

03: I partnered with IT to identify and evaluate business intelligence tools that could integrate with the company’s financial system (Oracle ERP)

Step 1: I developed scoring criteria based on business and technical requirements

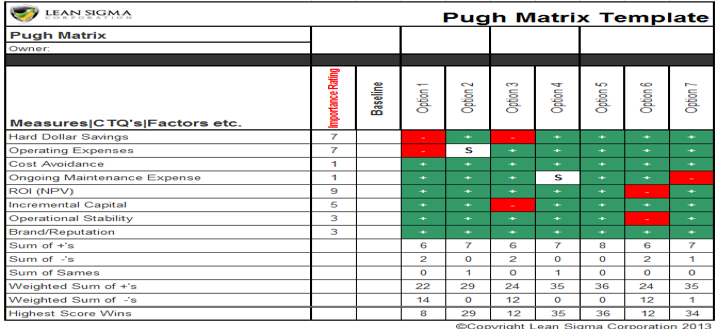

Step 2: I evaluated multiple business intelligence tools using a pugh matrix

- Pugh Matrix Template example

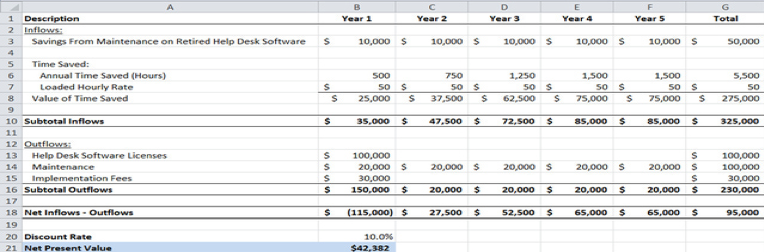

Step 3: I conducted a NPV analysis on the top 3 options

- NPV Analysis example

Step 4: I provided analysis and recommendations to C-level executives.

Ultimately, the three technologies that I recommended were selected.

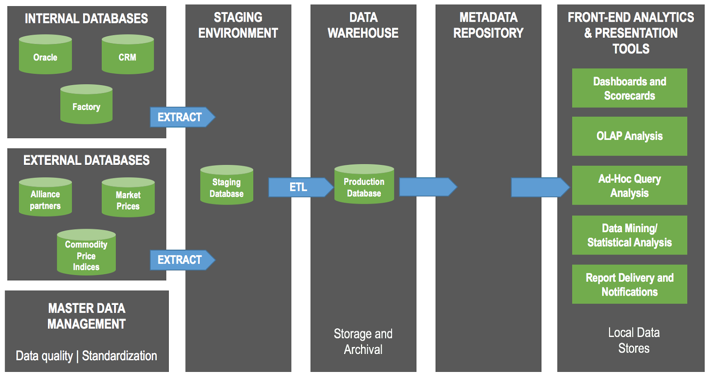

- Technology selections

04: I led the effort to integrate financial system with business intelligence software.

Step 1: Worked with members of IT team to construct “as-is” data schema.

This schema visualized data architecture of the company’s Oracle ERP system (Oracle SQL Modeler)

Step 2: Conducted gap analysis; compared data schema to requirements to identify:

- Missing data points

- Missing dimensions

- Data that needed more granularity

Step 3: Worked with members of IT to construct and document the “to-be” data model.

Here is a visualization of to-be data architecture:

05: Developed 20+ scorecards and dashboards for each business audience which allowed teams to monitor operational & financial performance.

Audience:

- C-Level officers

- Senior executive team members

- Management team members (multiple departments)

- Front-line employees (multiple departments)

Each dashboard included:

- Filters to change dimensions (date, categories, etc.)

- Drill-down data for deeper analysis

To minimize cognitive load and increase understandability, every dashboard had 4 common sections.

-

- Data points related to enterprise objectives

- Data points related to departmental objectives

- Custom data points and/or views specific to each audiences needs

- Industry benchmarks and data points

Results

- Increased visibility to real-time, actionable data.

- Enabled better, faster decision-making.

- Improved strategic planning and financial reporting activities.

- Reduced time spent by finance teams on report generation, increasing accuracy and usefulness of data.