Situation

In 2008, an EPA mandate required every gallon of gas sold in the US to include a minimum blend of 10% ethanol. This regulation introduced Renewable Identification Numbers (RINs) for tracking compliance, creating significant reporting and management challenges for Aventine, the largest ethanol distributor in the country. RINS were unique 36-digit numbers that had to be generated for each gallon of ethanol and transferred each time ownership of the ethanol fuel changed. The complexity of managing millions of RINs across a vast supply chain required a robust software solution to avoid substantial financial penalties for non-compliance.

Actions

I conducted analysis to understand regulatory changes and its impact on Aventine’s business.

- Conducted extensive analysis of regulatory changes, attending policy forums, studying regulations, and networking with industry peers.

- Evaluated existing business processes and technologies through interviews with suppliers, internal employees, and customers.

- Documented government requirements and crafted a comprehensive set of business and technology requirements.

- Initially, the rules and expectations provided by the government were ambiguous. Companies had to make decisions about technology investments based on regulations that could be interpreted in many ways.

- No system or tool existed that could dynamically create, track, and release RINs. Initially, RIN management was done manually, requiring significant labor and oversight.

- The chain of transfer for ethanol gallons from origin to delivery was often complex and long, involving many parties. This made tracking down RIN errors challenging.

- When gallons of ethanol are inventoried and sold, they are often mixed with other gallons. This creates complex combinations of RINs that need to be transferred.

- Crafting requirements for a regulation whose final requirements were unknown and in flux required making a lot of smart assumptions using the best information available.

- Because the EPA standard was new, other parties in the supply chain had not figured out their own processes and were not always able to provide clear answers.

- Each supplier and customer had a different way of managing the change and used different tools.

I evaluated RIN management software options.

- Developed scoring criteria based on business and technical requirements.

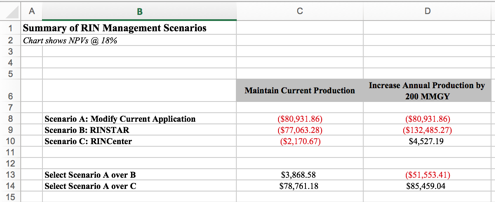

- Reviewed multiple software options using a Pugh matrix and conducted NPV analysis on the top choices.

- Recommended building a custom in-house software solution integrated with existing systems.

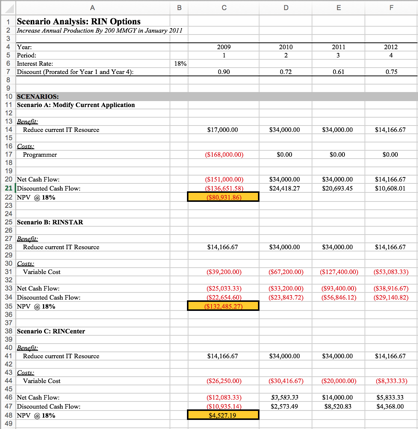

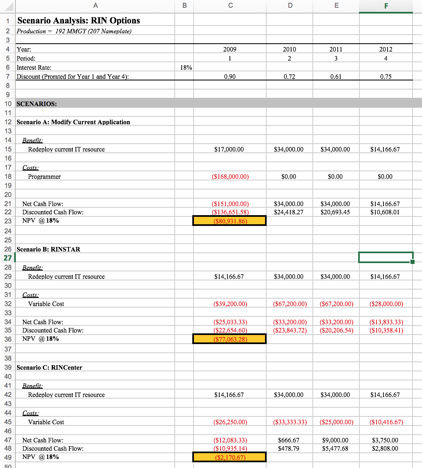

Example of NPV Analysis Note: fictitious data used in examples to preserve confidentiality

Scenario1: Annual production: 200MMGY

Scenario 2: Annual production: 400MMGY

Summary

I worked with an engineering team to develop and deploy a custom RIN management technology software.

- Gathered requirements from multiple stakeholders. Developed functional, technical, and data requirements

- Developing project plan and resource plan for implementation

- Designed the ideal RIN management system, including actor descriptions, task analysis, wireframes, and wireflows.

- Collaborated with IT teams to develop, test, and deploy the system, ensuring integration with finance (Oracle) and logistics tools.

- Provided training and education to team members throughout the deployment process

I identified opportunity to generate incremental profits through RIN trading.

Through my extensive study of the new government policy and conversations with policymakers, I discovered that excess RINs could be traded on the open market for profit. Armed with this information, I:

- Worked with sales and marketing teams to determine to how to sell RINS and create revenue stream.

- Developed a model for evaluating the profitability of RIN sales and created a process for managing independent RIN sales.

- Worked with IT to modify the system to support the new revenue-generating process.

Results

- The company stayed in compliance and avoided heavy penalties that many other companies incurred. Note: this company had the most robust distribution network in comparison to others, with many more opportunities for error.

- One of the first companies to openly trade “unattached” RINS on the open market for profit. This opened up a new revenue line, bringing in additional cash at a time when it was needed the most.